LaGuardia Terminal B

Puget Sound Capital Services LLC ("PSCSSEA") is a registered investment advisor pursuant to the Investment Advisors Act of 1940. We are dedicated to issuers and borrowers of tax-exempt and taxable debt, as well as other clients in both the private and public sector. PSCS specializes in the development and execution of investment strategy for debt proceeds, general funds and other types of funds. We offer turn-key management of competitive or negotiated procurement processes and post transaction management and servicing.

With the onset of the financial crisis in late 2008 and the resulting evaporation of the reinvestment market, PSCSSEA developed several creative and effective solutions to address the challenges of negative arbitrage and near zero interest rates.

In 2016, with the rise in interest rates, the investment provider universe rebounded, and the market began to see meaningful reductions of negative arbitrage. The portfolio of strategies and solutions developed by PSCSSEA can help maximize issuer/borrower/sponsor reinvestment options. The results have been substantial and effective negative arbitrage savings for its clients.

Since 2010, PSCSSEA has grown to become the industry leader in reinvestment of public private partnership (P3) bond proceeds. In recent years we have acted as reinvestment advisor and successfully closed most of the headline U.S. P3 bond transactions.

Our Professionals

PSCSSEA Founder and Principal Mr. William Chao is a veteran reinvestment specialist with over 35 years in the industry. Mr. Chao is one of the preeminent municipal reinvestment specialists in the country with comprehensive experience in the structural nuances of each type of issue, from housing to solid waste, military housing, health care, student loan, education, developer project finance, P3 financings and municipal infrastructure. Mr. Chao has been a pioneer and instrumental in the development of the municipal reinvestment industry. His client base extends nationwide with issuers from Puerto Rico to the State of Washington to Alaska and Hawaii. Since 1981, Mr. Chao has personally placed over $100 billion in municipal reinvestment transactions. These transactions involved among other investment vehicles, investment agreements, collateralized repurchase agreements, forward purchase agreements, flexible certificates of deposit and advance refunding escrow procurement.

Mr. Chao graduated with departmental honors from Stanford University and serves on various not-for-profit and community service boards and committees.

Services

Puget Sound Capital Services LLC ("PSCSSEA") is a nationally recognized leader in the reinvestment of tax-exempt and taxable debt proceeds. We work with issuers of tax-exempt and taxable debt, conduit borrowers (developers, hospitals, etc.), not-for profits and private sector entities. We are known for innovation and the ability to think “outside the box” to create solutions for today's reinvestment challenges. Since 2008, our focus has been on negative arbitrage solutions and we have developed a proprietary portfolio of strategies and solutions targeted toward a client's risk vs. reward profile.

Our approach to reinvestment is to work as part of the client's finance team to provide value added solutions. Working with the issuer, counsel, underwriter, municipal adviser and other key stakeholders, we manage the reinvestment process from initial investment strategy development to post transaction management. Our 35 years of industry experience and relationships have helped our clients realize tens of millions of dollars in negative arbitrage savings or additional investment earnings.

PSCSSEA is known for its professional, thorough, exact and disciplined management of reinvestment strategy design and execution. The process adheres to demanding industry standards for legal compliance and conduct.

What We Offer

- Typical Funds:

- Project/Construction, Capitalized Interest

- Debt Service Reserve

- Revenue (Float)

- Advanced Refunding Defeasance Escrows (Open Market Securities)

- Non bond proceeds

- Special situations

- Development of investment strategy and concept collectively with the transaction working group

- Analysis to determine best structure(s)

- Turn-key management of document preparation

- Management and coordination of working group tasks

- Management of approval process for various stakeholders

- Turn-key management of the procurement process (competitive or negotiated)

- Management of closing process

- Post-transaction management and service

Additional Projects

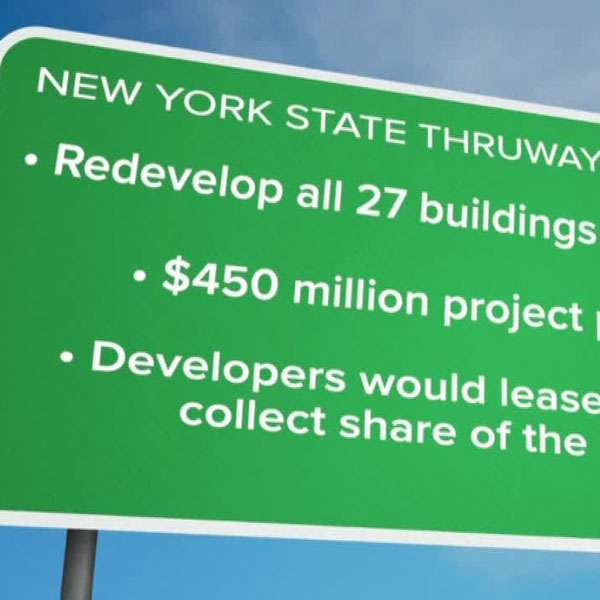

New York State Thruway Service Area

New York State Thruway Service Area Ohio Rivers Bridges East End Crossing

Ohio Rivers Bridges East End Crossing LAX Automated People Mover

LAX Automated People Mover